Helping crypto native companies navigate turbulent waters

Share

“If trailblazing were easy, the road would be paved,” goes the saying. It rings true for many companies and communities in the cryptocurrency space or crypto natives for short.

While no crypto native would want to give up their position as early adopters of digital assets, being ahead of the curve also has its challenges, especially when you come up against the limits of existing infrastructure.

This article outlines the major challenges that crypto-native companies face today and how they can navigate these challenges through Fintonia’s infrastructure, expertise and network.

What challenges do crypto natives face?

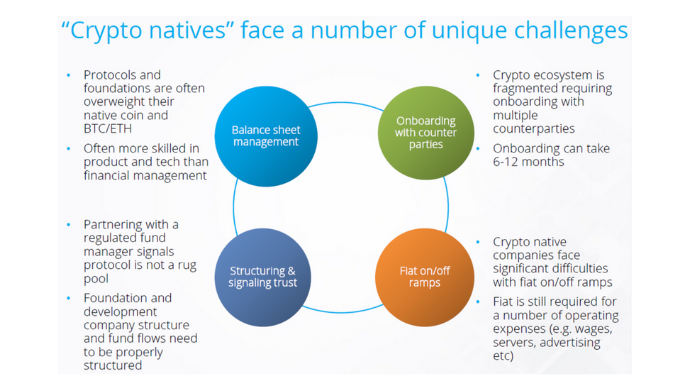

Crypto natives, including crypto token communities, crypto foundations and other entities that hold large amounts of crypto, face many challenges. Unfortunately, these challenges have not been given due attention and are ill-understood by the public.

Through our years of experience and expertise in the cryptocurrency ecosystem, Fintonia has identified four key areas that crypto natives face:

- Balance sheet management: Blockchain protocols and crypto foundations typically have outsize holdings in their native tokens, which results in significant concentration risk. For example, if Solana holds only SOL, and its price falls by 50 per cent, then Solana’s balance sheet would also be down by half.

-

Structuring and signalling trust: Crypto-native companies typically comprise founders and employees across the globe. With your team spread across myriad countries and tax jurisdictions, having a well-thought-out company structure is integral for success. Furthermore, although diversifying the treasury across non-native tokens is fiscally sound, any move to sell the native token can be interpreted negatively by the public; it can signal a loss of confidence in the protocol or even appear to be a “rug pull”!

-

Fiat on/off ramps: Crypto native companies still operate in a world that has not entirely accepted cryptocurrencies. The bulk of everyday business transactions, such as employee payroll, operational costs, and advertising spending, still have to be paid in fiat. However, the crypto/fiat exchange process is clunky and inefficient, not to mention costly. On top of that, traditional banks often shut down accounts associated with crypto companies.

Also Read: Cryptocurrency: Hero or villain for the payment industry?

-

Onboarding with counterparties: The chaos of the nascent cryptocurrency space makes it exciting. But, let’s admit, this fragmented ecosystem can be frustrating to operate a business in. Not only do crypto natives need to work with multiple counterparties, but counterparty onboarding can take as long as 12 months, resulting in major opportunity costs.

Why partner with a regulated fund manager?

As the crypto market gets bigger and infrastructural challenges increasingly apparent, more blockchain protocols and crypto firms seek out fund managers for their financial management services.

Fund managers can address the four key issues in the following ways:

- Balance sheet management: We understand it’s important to diversify the treasury across assets. However, this can be challenging to execute in-house if your talent pool skews heavily towards tech and product. A regulated fund manager provides financial management expertise and the appropriate custodian solutions for your needs.

-

Structuring and signalling trust: How do you structure your company properly? How do you meet your treasury’s needs without triggering negative public perception? A regulated fund manager can help structure the treasury’s portfolio, and fund flows to protect your assets and hedge against risk while sending the appropriate signals to the community.

-

Fiat on/off ramps: For better or worse, crypto natives still need fiat for day-to-day use. A regulated fund manager bridges the gap between traditional financial institutions and crypto firms, working with third parties to give clients access to banking solutions such as borrowing and lending.

-

Onboarding with counterparties: A well-connected fund manager allows crypto natives to eliminate the friction around counterparty onboarding. Clients can immediately leverage an established network of crypto exchanges and market makers and benefit from economies of scale.

In short, a regulated fund manager like Fintonia has the infrastructure, expertise, and network to address crypto natives’ challenges, helping them easily navigate turbulent waters.

How can crypto natives benefit from Fintonia’s solutions?

While asset management firms are a dime a dozen, not all are suited to working with crypto firms. Crypto natives need fund managers that understand the crypto ecosystem’s caprices, which can bridge the gap between traditional finance and digital assets.

Also Read: Breaking the bro code: How women are taking over the Web3 world in Asia

Fintonia Group, a regulated fund manager, specialising in digital assets, fits the bill. With over 100 years of experience in financial services and tech, we’ve built a financial ecosystem encompassing crypto natives, traditional financial institutions, and regulators.

As a registered Fund Management Company regulated by the Monetary Authority of Singapore (MAS), we offer institutional-grade investment products to professional investors and financial management solutions for corporates, including crypto-native firms.

Key services and benefits we provide include:

- Portfolio and asset management

- Bespoke yield generation strategies

- Cash flow planning

- Fiat liquidity management solutions

- Private key signatory

- Transparent monthly reporting on assets

We plan and execute tailored solutions to manage clients’ treasury assets via a Segregated Account. Benefit from our seasoned industry professionals’ expertise and tap on their trading experience and network within the crypto and traditional finance markets.

Interested? Here’s what to expect

The crypto space is as diverse as it is dynamic. So we take the time to listen and craft bespoke solutions for our crypto-native clients. Our approach is as follows:

- Understand business model, and fund flows: No two companies are the same. We start by deep-diving into the client’s company structure and business model. This includes organisational structure, financial drivers and forecasts, scenario planning and correlations, key business risks, financial and operational requirements, regulatory, tax, accounting and legal needs.

-

Determine strategy and fund flow: Having identified the client’s operational requirements and risk/return appetite, we propose a bespoke financial management strategy and asset allocation.

-

Strategy execution and adjustments: This is where the client leverages Fintonia’s solutions and network of institutional counterparties, including custodians, exchanges, market makers and selected DeFi solutions.

Our solutions may be tailored, but they’re far from set in stone. They are designed to evolve with the client’s needs, as befits a player in the fast-moving crypto space, so clients can also expect regular reporting, analysis, and quarterly strategy reviews and adjustments. More than just a service provider to handle treasury matters, we’re also a strong partner who can grow with your business.

As entrepreneurs and founders, Fintonia is uniquely placed to understand your needs and tailor solutions, helping you pave your way through crypto’s chaos.

Here is more information on Fintonia’s Treasury and Balance Sheet Management solutions.

–

Editor’s note: e27 aims to foster thought leadership by publishing views from the community. Share your opinion by submitting an article, video, podcast, or infographic.

Join our e27 Telegram group, FB community, or like the e27 Facebook page

Image credit: Canva Pro

The post Helping crypto native companies navigate turbulent waters appeared first on e27.